Why Consider This Portfolio?

The Growth Investing Midcap Opportunities Portfolio follows a rules-based approach focused on investing in select midcap companies with strong business growth and improving market performance.

The objective is to build long-term wealth by participating in companies that are growing faster than their peers, while maintaining discipline through regular reviews and risk controls. This portfolio is designed for investors who understand the higher volatility of midcaps and are comfortable with a long-term investment horizon.

How the Strategy Works :

-

Midcap Growth Focus

The portfolio invests in 10–12 carefully selected midcap stocks that show strong business fundamentals, growth visibility, and positive price trends. -

Systematic, Rules-Based Selection

Stock selection is driven by objective criteria that focus on growth and performance rather than short-term market noise. -

Balanced Portfolio Structure

All stocks are equally weighted, reducing dependence on any single company and helping manage concentration risk.

Risk Management & Portfolio Maintenance :

-

Ongoing Risk Control

Stocks are reviewed regularly and may be removed if business growth slows or performance weakens materially. -

Flexible Cash Allocation

When suitable opportunities are limited, capital allocation may be adjusted to maintain portfolio quality. -

Stability During Uncertain Phases

The portfolio is structured to remain disciplined during volatile or uncertain market conditions.

Investment Details :

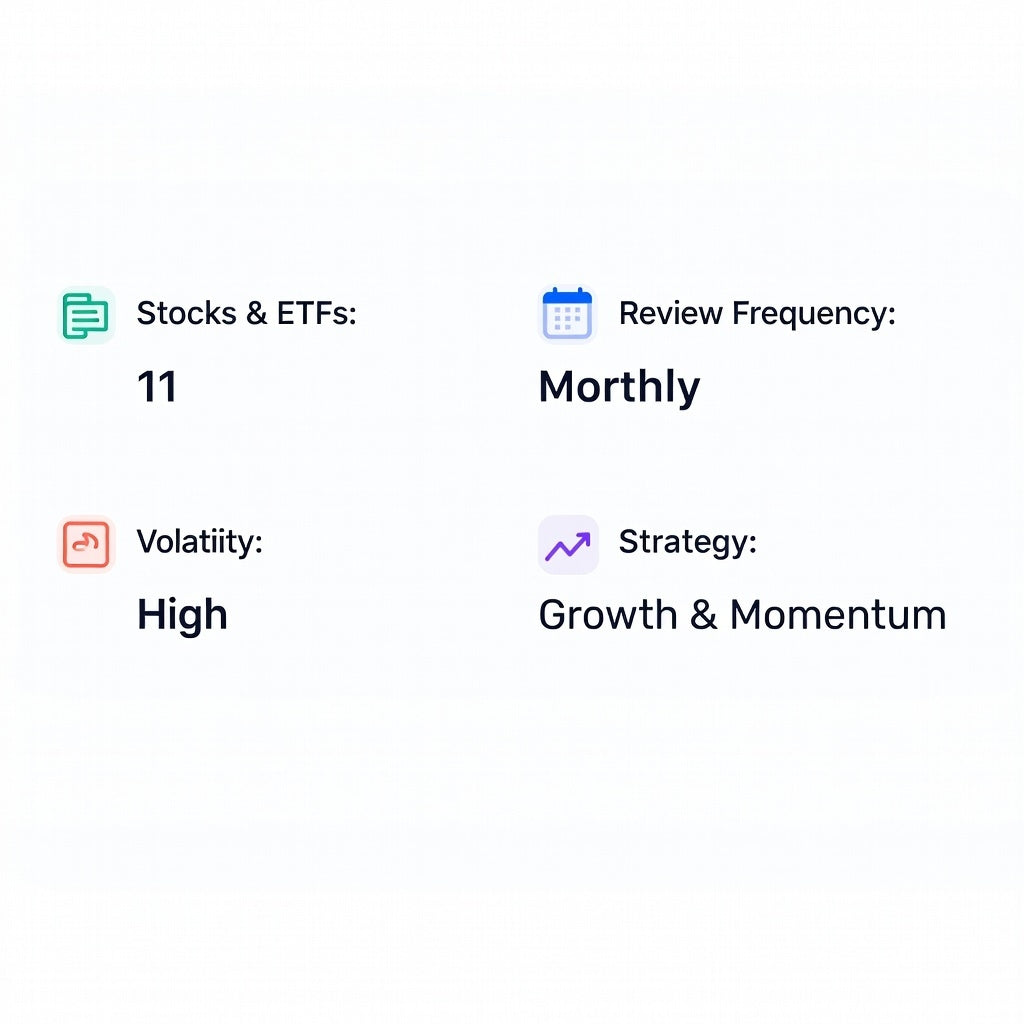

- Number of Stocks: 10–12 midcap companies

- Weighting: Equal allocation

- Rebalancing: Monthly review

- Investment Amount: Suitable for ₹1–25 lakh

-

SIP Option: Monthly SIP on the 10th of each month

A structured midcap strategy for investors seeking long-term growth with discipline.

Stocks & ETFs

11

Rebalance Frequency

Monthly

Last Rebalance

December 30, 2025

Next Rebalance

Feb 11, 2026

GENERAL QUESTIONS

Everything you need to know before getting started.

Who is this portfolio suitable for?

What kind of companies does the portfolio invest in?

How is this different from large-cap or index investing?

Is this portfolio risky?

What is the recommended investment horizon?

- Choosing a selection results in a full page refresh.

- Opens in a new window.