Why Consider This Portfolio?

The Growth Investing Nifty Next 50 Portfolio focuses on companies from the Nifty Next 50 Index — businesses that are often in an expansion phase and have the potential to become future market leaders.

The portfolio follows a rules-based momentum approach, using a proprietary model to identify stocks showing strong growth characteristics and improving market performance. It is designed for investors with a 3–4 year investment horizon who are comfortable with moderate volatility in pursuit of long-term growth.

How the Strategy Works :

-

Future Market Leaders Focus

The portfolio selects 10 stocks from the Nifty Next 50 universe — companies that are well-placed to move into leadership positions within their sectors. -

Systematic Stock Selection

Stock selection is driven by the Growth Accelerated Momentum System (GAMS), combining growth indicators with price trends. -

Balanced Allocation

Each stock is allocated between 8%–10%, helping balance growth potential while avoiding over-dependence on any single company.

Risk Management & Portfolio Maintenance :

-

Regular Reviews

The portfolio is reviewed monthly and rebalanced only when required, keeping it aligned with changing momentum and market conditions. -

Diversified Growth Exposure

The portfolio maintains diversification across sectors and includes a mix of relatively stable and higher-growth companies. -

Transparent Ownership

All stocks are held directly in the investor’s demat account, providing full visibility and control.

Investment Details :

- Number of Stocks: Up to 10

- Weighting: ~8%–10% per stock

- Investment Horizon: 3–4 years

- Investment Amount: ₹5–30 lakh

-

Rebalancing: Monthly, need-based

disciplined approach to investing in companies positioned for the next phase of growth.

Stocks & ETFs

2

Rebalance Frequency

Monthly

Last Rebalance

Dec 9, 2025

Next Rebalance

Feb 10, 2026

GENERAL QUESTIONS

Everything you need to know before getting started.

Who is this portfolio suitable for?

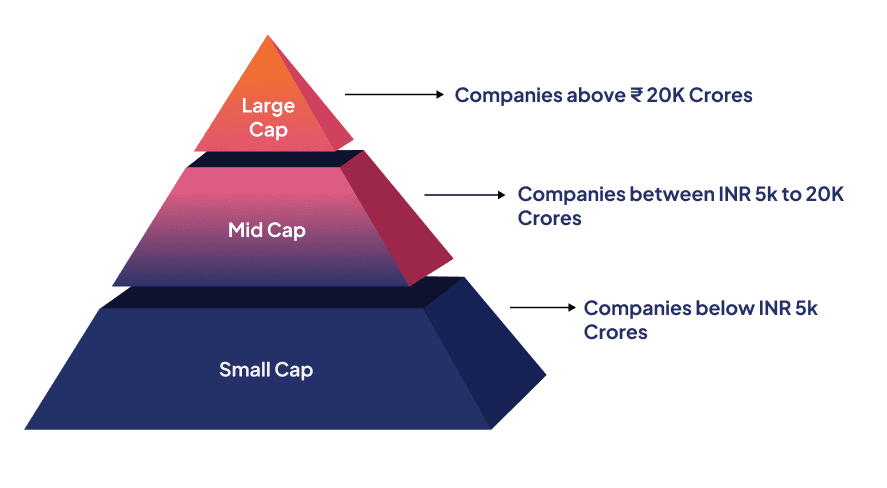

What kind of companies does it invest in?

How is this different from investing directly in the Nifty Next 50 index?

Is this portfolio risky?

- Choosing a selection results in a full page refresh.

- Opens in a new window.