Why Consider This Portfolio?

The Growth Investing Large Cap Leaders Portfolio offers exposure to India’s largest and most established companies through a simple, rules-based structure.

The portfolio is designed for investors looking for stability, simplicity, and long-term participation in leading businesses that have demonstrated consistent earnings and resilience across market cycles. It is suited for investors with a 3–4 year horizon who prefer a disciplined approach with minimal portfolio churn.

How the Strategy Works :

-

Focus on Market Leaders

The portfolio invests in 10 large-cap companies with strong business scale, stable earnings, and long operating histories. -

Systematic Stock Selection

Stocks are selected using a Growth Accelerated Momentum framework, combining business performance with market trends. -

Simple, Equal-Weight Structure

Each stock is allocated approximately 10%, reducing over-dependence on any single company and keeping the portfolio easy to track.

Risk Management & Portfolio Maintenance :

-

Need-Based Rebalancing

The portfolio is reviewed periodically and rebalanced only when required, helping keep churn and transaction costs low. -

Built for Different Market Phases

Large-cap companies typically show greater resilience during volatile markets, supporting a more stable investment experience over time. -

Full Transparency & Control

All stocks are held directly in your brokerage account, giving you complete ownership and visibility at all times.

Investment Details :

- Number of Stocks: 10 large-cap companies

- Weighting: Equal-weight (approx. 10% each)

- Investment Horizon: 3–4 years

- Investment Amount: ₹5–30 lakh

- Rebalancing: Need-based

A structured large-cap portfolio for investors seeking long-term stability with discipline.

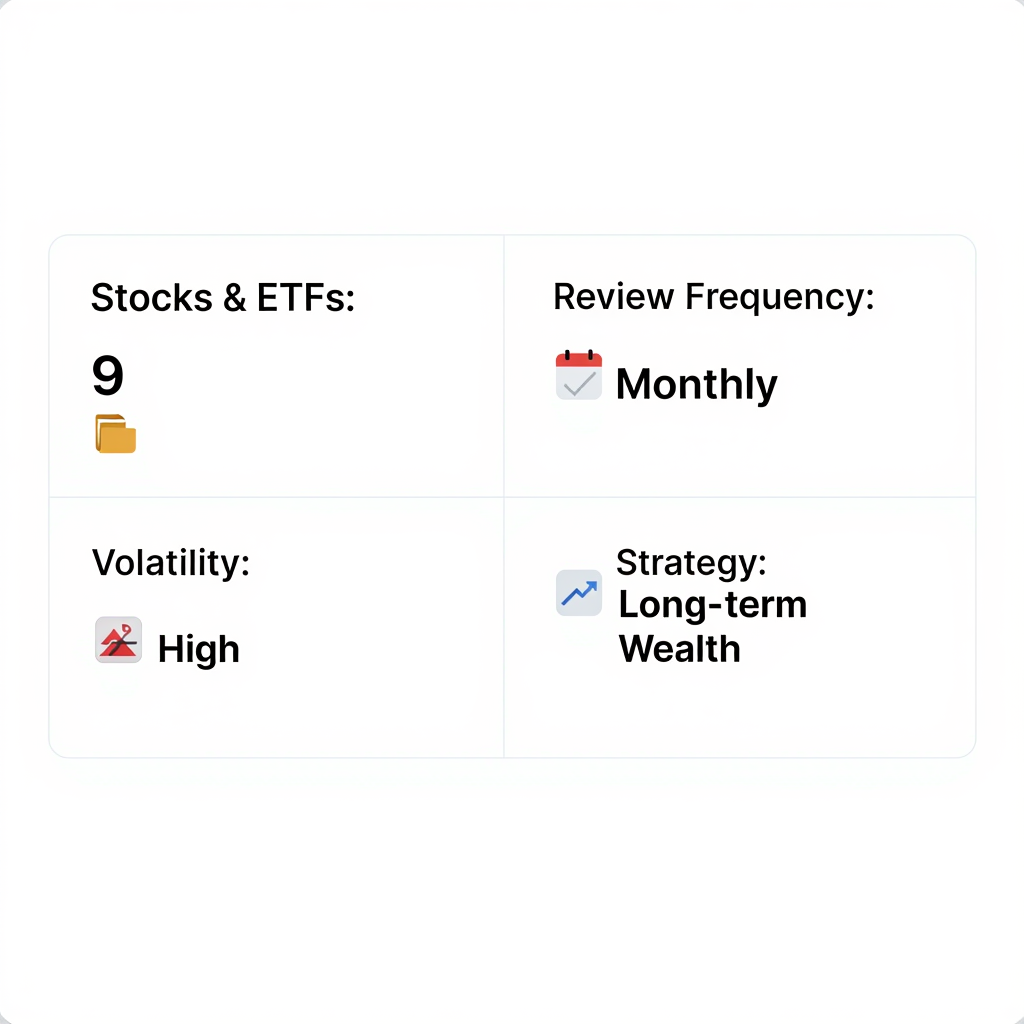

Stocks & ETFs

9

Rebalance Frequency

Monthly

Last Rebalance

Dec 9, 2025

Next Rebalance

Feb 10, 2026

GENERAL QUESTIONS

Everything you need to know before getting started.

Who is this portfolio suitable for?

What type of companies does the portfolio invest in?

How is this different from a Nifty 50 index fund?

Is this portfolio suitable for volatile markets?

Is the subscription fee worth it?

- Choosing a selection results in a full page refresh.

- Opens in a new window.